I am an Engineer by training, and I did consultancy for years doing risk assessments and the like. There are many types of risk assessments that you could do, depending on the complexity, and what you really need.

Recently, I did a "What- If" risk assessment for myself if I were to become jobless, and I found some interesting facts.

About What-if risk assessment

There's a formula for risk: Risk = consequence x probability

A what- if risk assessment is essentially, looking at what will go wrong, determine its probability and consequences, then determine if this is risk is acceptable or unacceptable. For those risks that are unacceptable (consequence x probability is too high), actions need to be taken to minimise or eliminate the risk.

To break down the steps of a what- if risk assessment, it involves first looking at what could go wrong.

In the process industry, it could be human error, equipment failure, loss of critical utilities, deviation from planned parameters (e.g. too high a temperature, etc.).

Once you have the list of the items that could go wrong, base it on your existing safeguards that you have, what are the consequences, and the probability of this happening. Estimation of probability should be easy for an existing plant - look at statistics of past breakdown, or if not go to some journals or publications to get an estimation of the probability of the event happening. For consequences, it's very process specific. If you have a pump that is supplying chilled water to a reactor to prevent it from overheating, then it is likely to be critical with high consequence. But if you have a pump that supplies chilled water to air - condition your office, then if it is down, then it will just be a hot day for everyone (low consequence). But this is assuming there are no safeguards. We could have backup systems which will reduce the consequences.

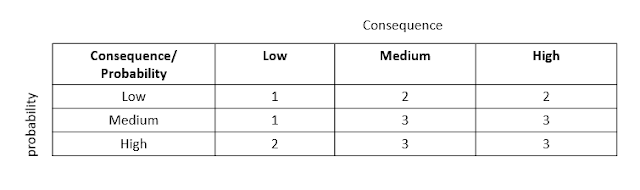

Once you have looked at each scenario that could go wrong, and determine the consequence and probability, determine what's tolerable and what's not. For those that are not tolerable, you definitely need action item to bring the risk to what you feel is tolerable. For those that's within the tolerable range, you could decide to further enhance the risk. Many companies use a risk matrix to rank acceptable and unacceptable risks.

If you are interested in a risk assessment template, you could get it from American Chemical society (ACS). I've provided a link here:

here.

Applying the What-if risk assessment To myself

Since I'm looking at the scenario of being jobless, I took a risk assessment. Note that I have modified the template from ACS totally to match myself. The whole "what- if " scenario is basically what if I have no job. From there, I looked at the implications associated with having no job, and then assess each implication.

Any risk ranked 3 needs action items to reduce risk. The risk matrix for the risk assessment is as follows. All definitions are my own definitions, and unique to non other than myself.

Consequence rating defined as follows:Low - if the consequence is something I don't care about and don't affect my life in a way that matters to me.

Medium - I do care about and affect my life a little in a way that matters to me.

High - I really care about, and will have a significant impact on my life

Probability rating defined as follows:

Low - not likely to happen until 20 years later

Medium - not likely to happen until 5 years later

High - likely to happen within the next (1- 5 years)

|

What if I’m

jobless?

|

Existing

safeguards

|

Consequences/ Probability

|

Is risk

acceptable?

|

Action items

to improve risk

|

Is risk

acceptable after completion of action items?

|

|

No income.

|

Having $6k/

year of interest/ dividend income from stocks/ bonds.

Savings –

enough for a few years.

|

No money for necessities after a few years.

Cannot give kids the best enrichment, etc.

Have to teach kids myself.

Probability - low for first few years; high subsequently Rating - 3

|

No

|

Increase passive income streams to last

savings beyond a few years. Lower expenditure so that savings can last more than a few years.

Side hustle for additional income (e.g. giving

tuition, etc.)

|

Yes

|

|

Becomes less

employable in my industry. (employers associate periods of unemployment as

undesirable, making one less employable or demand lower pay in future)

|

Read up (keep up- to- date) with my industry. Catch up with colleagues to find out the latest happenings.

|

Lower employability. Probability: medium Rating: 1

|

Yes

|

N/A

|

N/A

|

|

No dental and

health benefits from employers.

|

-

Own medical insurance

-

Pay for own dental from income (see item 1)

|

N/A Probability: low Rating: 1

|

Yes

|

To further

enhance risk, the following could be done:

-

Exercise well and eat well

|

|

|

having something to do

|

Have too many things I want to do apart from work. (LOL)

|

- Low probability/ consequence Rating: 1

|

Yes

|

-

|

|

|

Professional

network decreases

|

Keep in contact with colleagues

|

Lose industry news.

Medium probability/ low consequence Rating: 1

|

Yes

|

-

|

|

|

Social circle

|

-

Meet up with existing friends

|

-

Stagnating social circle Low consequence (to me) / medium probability Rating: 1

|

Yes

|

|

|

|

Cannot get a loan

|

N/A

|

-

Amount of loan is assessed based on income. With

no income means no loan. high probability/ medium consequence

Rating: 3 | No. |

Don't change property. Encourage partner shoulder any future loan. Don't loan. Pay upfront. - Have enough money before buying any property.

|

Yes.

|

|

Cannot service

existing mortgage

|

-

Enough funds in CPF OA and savings to cover

loan

|

n/a

Rating: 1

|

Yes

|

-

|

-

|

Follow- up Actions

Once the "What-if" risk assessment is done, and approved, the next step is to create a list of the action items, put in the action party, and estimated date of completion. Tracking of this list will then be done from time- to- time.

Conclusions

Based on my risk assessment above, being jobless mainly have real implications on me having a source of income. However, this impact will not affect me now, but rather years down the road. As long as I find ways for the next few years to get some income apart from a corporate job, I should be fine.

Comments

Post a Comment